Your payment deserves a holiday!

Free up your money for whatever you need with our Skip-a-Pay Program.

The Members Choice Skip-a-Pay Program is a benefit we offer our loan account holders just for being members. With Skip-A-Pay, you can skip a qualified loan payment without impacting your credit score.* That payment will then be added to the end of the loan’s term.

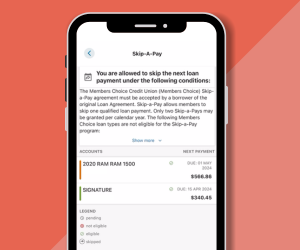

Quickly request your skip through your MCCU Online Banking or Mobile App

- Login to your online banking account via desktop or mobile app

- Head to "Tools and Support" menu and select Skip-a-Pay

- View and select your eligible loan skip

- Agree to the Terms and Conditions

- Remove any auto-payments for the month, and once approved, you're all set!

Request your skip by email, fax or in person

- Download the PDF form

- Fill out the form–include the account info for your eligible loan skip

- Sign to agree to the Terms and Conditions

- Return the form by email, fax, or in person at our branches

- Remove any auto-payments for the month, and once approved, you're all set!

Is there a fee to use the Members Choice Skip-A-Pay Program?

- When you request your skip through your online banking or mobile app, there is a $15 processing fee per loan, per skip for this benefit. Plus, you'll be able to see right from the screen which loans are eligible.

- When you request your skip by sending in the PDF form by email, fax, or in person, there is a $25 processing fee per loan, per skip for this benefit.

- We want to make it easy, so if your request is not approved, you will not be charged a fee.

Who is eligible for the Skip-a-Pay Program?

- Members must be in good standing (not delinquent or have a negative balance) on all accounts, including co-signer account(s). Any currently delinquent loan, or a loan which has been previously delinquent, may be ineligible.

- Loan must be current or in grace period; this includes any loans under your name.

- Loan must have at least six payments credited.

- Loan must not have had more than two skipped payments under this program within a calendar year.

- Skipped payments cannot occur in two consecutive months; you must wait at least 60 days between skips.

What loans are eligible for Skip-a-Pay?

- New and pre-owned auto loans

- Signature unsecured personal loans

- Unsecured personal loans

- Boat/RV loans

What loans are not eligible for Skip-a-Pay?

- Any loan over $75k

- Any real estate or land loan

- Any line of credit

- Credit cards

- Business loans

- Share / Stock / CD-secured loan

- Student loans

- Teacher loans

- Smart Choice auto lease

- Revolving loans

- Payroll interruption loans

- Recovery loans

- Loans not serviced by Members Choice

Will participating in the Skip-a-Pay program affect my loan?

Yes. The skipped month(s) will be added to the end of your loan, extending the loan term. Interest will continue to accrue during skipped month(s).

Skip-A-Pay FAQs

Bill Pay is different from automatic (ACH) payments. If you use Members Choice online banking Bill Pay or Bill Pay from any other financial institution, you’ll need to log into Bill Pay to stop and restart the payment yourself. Don’t forget to turn it back on after your skip!

* The Members Choice Credit Union (Members Choice) Skip-a-Pay agreement must be signed by a borrower of the original Loan Agreement.

The following Members Choice loan types are not eligible for the Skip-a-Pay program: Any loan over $75k, any real estate loan (including Mortgages, Home Equity, Home Improvement, land loans and HELOCs) or line of credit, credit cards, business loans, share secured, stock secured, CD secured, student loans, teacher loans, Smart Choice auto lease, payroll interruption loan, recovery loan, any loan originated within the past six (6) months, loans not serviced by Members Choice and any delinquent loan. Any currently delinquent loan or a loan which has been previously delinquent, may be ineligible. Any payment deferrals or previous extensions may affect eligibility. Loan must have at least six (6) payments credited. By enrolling in Skip-a-Pay, you agree to the terms and conditions and you are requesting Members Choice to skip one monthly payment and advance the due date of your regular monthly payment by one month. Please note that by choosing to defer/skip payments on your loan(s) this may affect future payment on Life, Disability or GAP claims.

There is a $15-$25 processing fee per approved loan skip that will be deducted from any Members Choice account, depending on if the skip was processed through digital banking or by submitting a PDF form; in addition, enrollment in the program means you authorize Members Choice to extend your final loan payment as needed. Your payment will revert back to your original payment schedule and due date following the skipped payment. Payments and credits shall be applied in the following order: accrued interest or finance charges; outstanding principal, any amounts past due. Payments made in addition to the regularly scheduled payments shall be applied in the following order: accrued interest or finance charges; outstanding principal, any amounts past due. In some cases, based on the size of your balance, the accrued interest may be greater than the amount of your next regular payment; it may take several months to begin to reduce your principal balance. Submitting the application does not guarantee approval. Members Choice has the right to refuse any Skip-a-Pay request. You agree to hold Members Choice harmless for any consequences resulting from rejection of Skip-a-Pay request. If your application is rejected, you will not incur a fee, and you will be notified by email. All other payment terms of your Loan Agreement/Promissory Note will remain in full force and effect.

The maximum aggregate number of skips and extensions should not exceed the following based on term:

36-month term – Maximum of 5 skips

48-month term – Maximum of 6 skips

60-month term – Maximum of 8 skips

72-month term and greater – Maximum of 9 skips