Get more peace-of-mind with Choice Pay Overdraft Protection

Choice Pay Overdraft Protection has you covered

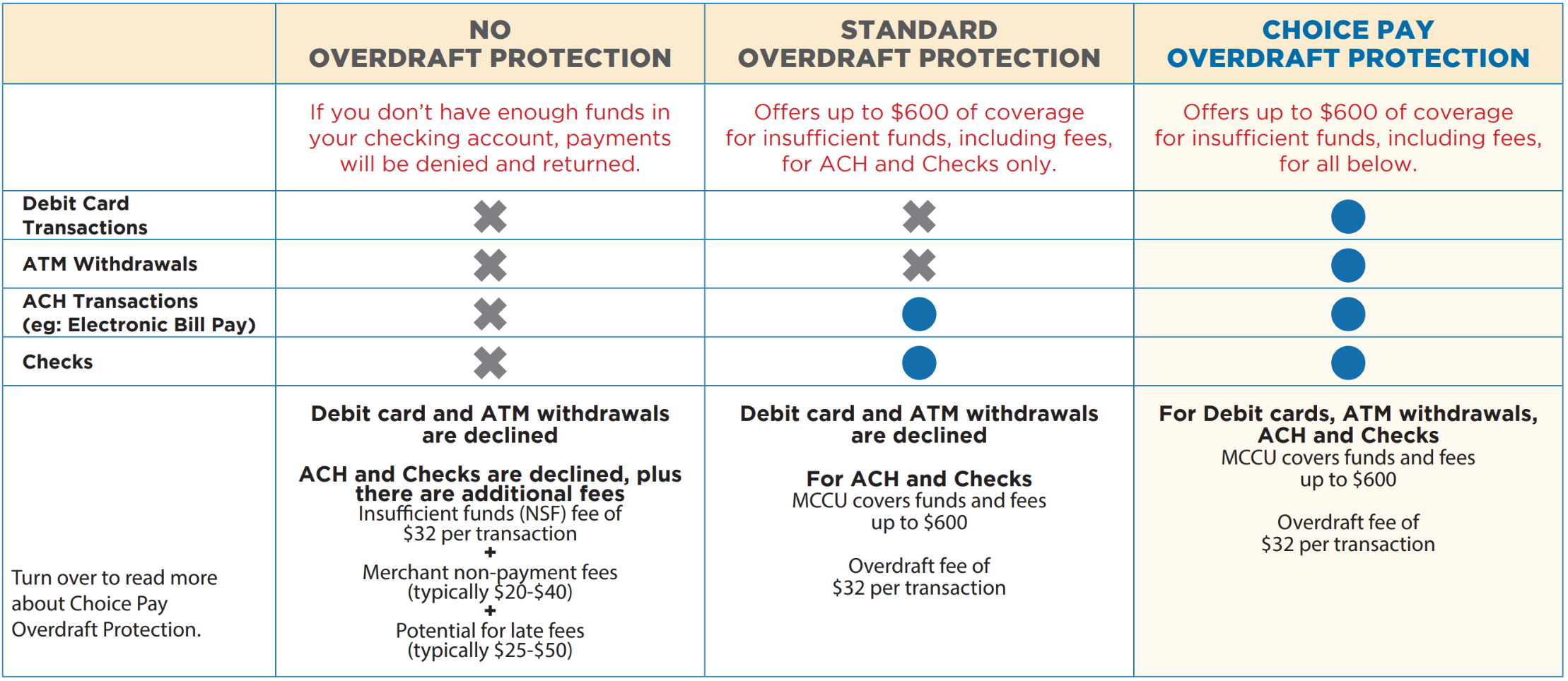

If you don’t have enough funds in your checking account, Choice Pay is a service where Members Choice offers to pay your overdrafts up to a $600 limit. When you opt-in and are within the coverage limit, Choice Pay can:

- Help prevent your debit card transaction from getting declined when paying a bill, buying groceries, etc.

- Help prevent your ATM cash withdrawal from getting declined

- Help prevent other fees from bounced checks, or automated bill and mortgage payments stopping your payments

How to opt-in to Choice Pay

Ask us about linking other Members Choice accounts as overdraft protection too.4

Standard overdraft protection is a service we provide that is similar to a loan; Members Choice covers additional payment requests when a checking account’s balance is inadequate. Standard overdraft protection comes with your checking account and provides funds to cover a check or electronic transactions (ACH) up to $600 including fees, when your account balance is inadequate to payment request. Each overdraft request will be charged $32 and deducted from your total balance.

The overdraft allows you to continue withdrawing money (up to $600) even when the account has no funds in it or has insufficient funds to cover the amount of the withdrawal. Standard overdraft protection does not apply to ATM transactions or to debit card transactions unless you notify us that you would like to opt in to Choice Pay overdraft protection for such transactions.

Disclosures

1 Choice Pay for new personal members will begin after 30 days of membership, and after 60 days of membership for business members. Choice Pay is a service that is provided at Member Choice’s discretion and is subject to approval and may be revoked by MCCU at any time. The Choice Pay limit is $600 (including fees). Member must replenish account and be at a positive balance at least once every 30 days. We will charge you an overdraft fee of $32 each time we pay an overdraft. You may incur multiple fees in one day. Once you reach the $600 limit we will not pay any other transactions if you do not have sufficient funds.

3 Regardless of your choice to opt-in, Members Choice pays overdrafts at our discretion, which means we do not guarantee that we will always authorize and pay any transaction, and in those cases the transaction will be declined. MCCU retains the right to pay or not pay any transaction(s) if you do not have sufficient funds available, if you have not authorized a transaction, if your account is not in good standing, or if you have reached your $600 limit. Each $32 fee is deducted from your total balance.