Hold up… You’re not using all the perks of your new Members Choice Complete Checking® Account?

Let’s fix that!

We’re excited you opened a Members Choice Checking account. Now, let’s make sure you’re getting all the benefits. It’s time to get everything set up so you can use those benefits anywhere, anytime. Let’s do this together!

Here's what your account comes with:

- Debit Mastercard®

- Mobile and online banking

- Mobile wallet

- Send and receive money with Zelle® 1

- Direct deposit

- Worldwide ATMs

- Bill pay

- eAlerts and eStatements

- Check ordering

- Unlimited check writing

Here are the next steps to set up your new checking account:

Set up your online banking account

Set up your online banking accountStay on top of all your accounts and handle alerts and budgeting with zero stress.

Get protection just in case you slip up on payments or run into a little cash crunch.

You will need the Members Choice Credit Union Routing/ABA Number (313083196) and your account number.

Activate Your New Debit Mastercard®

Your new Debit Mastercard gives you fast and secure access to your funds for everyday and special purchases.

Here is what you need to know about your new card:

- Your new debit card will arrive in the mail in 7-10 days

- Activate your card and set up your PIN by calling 833.246.9309 -

enter your new debit card number followed by #

enter the expiration date found on the back of your card MMYY followed by #

enter the last 4 digits of your social followed by #

enter your date-of-birth in this format MMDDYY followed by # - Then you will be prompted to set up your new PIN; your previous PIN will not transfer and you will need to set a new one.

- Test it out on your next purchase

- Use you debit card anywhere the Mastercard logo is found

- Set up your bill pay and automatic withdrawals

- Explore the great features and benefits (PDF) of your new Debit Mastercard

- Tap to pay confidently in-store and online using your smart phone in:

- Apple Pay using compatible Apple devices

- Google Pay using compatible Android devices

- Samsung Pay using compatible Samsung devices

- Microsoft Wallet using compatible Windows phones

- Fitbit Pay using compatible Fitbit devices

Debit Card FYIs

Lost or Stolen Visa Debit Card

To report a lost or stolen Debit Mastercard, call 833.246.9309 immediately. We also recommend that you review your account for any unauthorized transactions and to contact us for any further steps that may need to be taken. To temporarily your card, please login to online or mobile banking, go to "Manage My Cards" under the "Account Menu" and block your card.

Card Disputes & Fraud

If you find unauthorized charges to your account, Members Choice will work with you to dispute those charges or report any fraudulent activity. Visit the Card Disputes & Fraud site to find answers and solutions to your questions.

Purchase Alerts

One way to proactively manage your debit card transactions is to monitor charges. The Members Choice e-alerts provides you with email or text alerts when transactions are made with your debit card. Click here to learn more and set up your alerts today.

Set up your online banking account

Activate your online account access by following these easy steps:

- Have your account number ready and go to https://secure.mccu.com/Registration

- Your account number is located in the upper left corner of the first page of the Member Service Agreement you received when you opened your new account.

- Click on “Register as an individual”

- Review and Agree to the Online Banking Access terms and click Continue

- You can also print these terms by clicking on the print icon

- Confirm your identity by supplying your Account Number, your social security (or tax ID number), your date of birth, email address and zip code.

- You will be prompted to create security questions.

- Congratulations, you are managing your finances online! Now you can:

- Pay bills online

- Set up a budget

- Transfer money

- Monitor accounts

- Deposit checks

- Quickly add shares and/or loan products

- Customize your account names to fit your needs

Online banking - Enroll to get started

For questions:

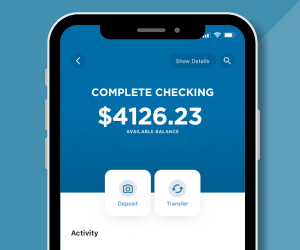

Download Members Choice App

The Members Choice mobile app features:

- Mobile push notifications and alerts

- Fingerprint/Touch ID authentication

- Mobile check deposit

- Mobile Wallet for Apple Pay, Google Pay and more

- Block/Unblock your debit card

Activate your mobile access by following these easy steps:

- Download the Members Choice Credit Union app in the App Store or Google Play

Apple Users

Search the app store for Members Choice Credit Union, select and download. You will be prompted to create security questions. In the app store, there is also a version of the app available for Apple Watch so you can quickly check available balances anytime.

Android users

Search the Google Play Store for Members Choice Credit Union, select and down - You will be prompted to create security questions.

- Enter the same username and password from online banking and continue through the enrollment process

Now you're set up to manage your account anytime, anywhere!

Fast and convenient, it’s the easy way to pay with your smartphone

Your digital wallet is available in:

- Apple Pay using compatible Apple devices

- Google Pay using compatible Android devices

- Samsung Pay using compatible Samsung devices

- Microsoft Wallet using compatible Windows phones

- Garmin Pay using compatible Garmin devices

Visa Mobile Wallet is:

- Convenient — experience all the benefits of Visa on your mobile phone or device.

- Secure — your transactions are always backed by the security of Visa. When you use Visa on your digital devices, Visa Token Service helps you build and maintain your digital payment experiences while protecting your sensitive information from fraud with a unique digital identifier — a “token”.

- Accepted — look for the Contactless Symbol at checkout.

Three simple steps for adding and using your Members Choice Debit Mastercard® mobile wallet.

- Add your Debit Mastercard to your payment-enabled mobile phone or device

- Look for the Contactless Symbol on the terminal at checkout

- Hold your phone or device over the symbol to pay

Set up your Zelle® account

Set up Zelle® for a fast and convenient way to electronically send and receive money with people you trust.

What is Zelle®?

Zelle® is a fast and convenient way to electronically send and receive money with friends, family and others you trust, even if they bank somewhere different than you. You can use Zelle® to do things like gift people money, pay the sitter, or split the cost of a night out with friends.

Zelle® is accessible for members with Members Choice Complete Checking® and Cash Back Checking available in your online and mobile banking account.

For Members Choice Credit Union Opportunity Checking account holders, click here for instructions on connecting your Debit Mastercard to the Zelle® app.

How do I enroll in Zelle®?

Step 1: Log in to the MCCU Houston TX app.

Step 2: In the main menu, select "Transfer and Pay". Then "Zelle®".

Step 3: Enroll your email address or U.S. mobile number.

How can I access Zelle®?

You can send, request, or receive money with Zelle®. To get started, log into the MCCU Houston TX app or online banking. In the main menu, select "Transfer and Pay". Then "Zelle®".

How do I use Zelle®?

To send money using Zelle®, simply select someone from your mobile device's contacts (or add a trusted recipient's email address or U.S. mobile number), add the amount you'd like to send and an optional note, review, then hit "Send." The recipient will receive an email or text message notification via the method they used to enroll with Zelle®. Money is available to your recipient in minutes if they are already enrolled with Zelle®.

To request money using Zelle®, choose "Request," select the individual from whom you'd like to request money, enter the amount you'd like, include an optional note, review and hit "Request". If the person you are requesting money from is not yet enrolled with Zelle®, you must use their email address to request money. If the person has enrolled their U.S. mobile number, then you can send the request using their mobile number.

To receive money, just share your enrolled email address or U.S. mobile number with a friend and ask them to send you money with Zelle®. If you have already enrolled with Zelle®, you do not need to take any further action. The money will be sent directly into your Members Choice Credit Union account, typically within minutes.

If someone sent you money with Zelle® and you have not yet enrolled with Zelle®, follow these steps:

-

Click on the link provided in the payment notification you received via email or text message.

-

Select Members Choice Credit Union.

-

Follow the instructions provided on the page to enroll and receive your payment. Pay attention to the email address or U.S. mobile number where you received the payment notification—you should enroll with Zelle® using that email address or U.S. mobile number to ensure you receive your money.

Set Up Direct Deposit

Set up direct deposit to your checking/savings account for a reliable and convenient way to get paid.

Direct deposit of your payroll, social security or other regular payment can be an effective way to help you budget and protect against identity theft, even while you are away.

EZSwitch Direct Deposit

This is the fast and easy way to setup direct deposit right from your online or mobile banking. Plus, you don't need to reach out to your payor or HR department. Sets up in minutes!

Direct Deposit from your employer

Contact your payor and request to have your payroll check automatically deposited into your Checking/Savings account. Use your member account number to complete the process. Your employer may request this information to set up direct deposit for your regular payroll check:

- Credit Union Name: Members Choice Credit Union – Houston, TX

- Type of account: (checking or savings)

- Routing / ABA number: 313083196

- Account number: Your checking or savings account number - access by logging in to online banking. Here are the steps to find that number:

-

- Go to mccu.com

- Enter your username and password in Account Logins, then click Login

- Once you are in online banking, select the Accounts widget

- Select the checking or savings account you would like to use

- Select Account Details, then locate the full MICR Account Number (13 digits)

Use MyPay if your direct deposit originates from:

- Active Duty Military Service Pay

- Reserve Military Pay

- Military Retirement Pay

- Department of Defenses (DoD) Pay

- Defense Finance and Accounting Services Pay

Use Standard Form 1199A or Go Direct if your direct deposit originates from the United States Treasury for:

Set Up Choice Pay Plus Overdraft Protection

Just in case you didn’t sign up for Choice Pay Plus Overdraft Protection, it’s not too late.

Overdraft protection may cover up to $600 if your account goes over and it can be linked to more than one Members Choice account. Click here to learn more and sign up for Choice Pay Plus today: