Meet your go-to checking account—earn up to 4.07% APY.*

Members Choice Complete Checking® is a high-yield checking account that pays you interest on your money just by using it. This will give you more cash to do what you want—like finally taking that dream vacation or splurging guilt-free!

Everything you need:

- Earn up to 4.07% APY* with no minimum balance requirements1

- Get paid up to two days early with Early Pay2

- Send and receive money with Zelle® 5

And nothing you don't need:

- No monthly service fee regardless of your balance

- Plus, you can skip the ATM fees3

Make everyday spending count

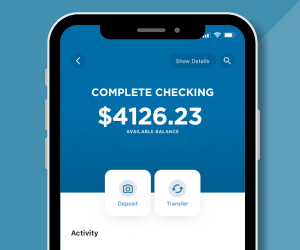

With a checking account that earns interest, your daily expenses like coffee runs, groceries, and nights out become way more rewarding. You’ll have extra cash to enjoy more of what you love. Plus, you can easily manage your account on our mobile app—lock your card, get alerts, set spending limits, and pay your friends back right from your phone.

Earn more on every dollar

You’ll earn extra cash on the balance that’s in your bank account every month—way more than what you'd see with a regular savings account at your local bank. This means more money for fun stuff like weekend getaways or even just a little extra for your everyday spending.

Never miss a payment with Early Pay

Plus these benefits3

- No monthly maintenance fee

- Overdraft protection up to $600 with Choice Pay Plus6

- Debit Mastercard®

- Mobile and online banking

- Mobile wallet

- EZSwitch Direct Deposit

- Bill Pay

- eAlerts & eStatements

- Unlimited check writing

- Send and receive money with Zelle®

- Access to over 55,000 ATMs worldwide

- ATM fee rebates (Members Choice and Foreign) up to $25/month

Have a Side Hustle? Check out Side Hustle Banking.™Balancing a full-time job with a side business is no small feat. That's why we've crafted the ultimate banking solution tailored just for you—the passionate, the ambitious, the side hustler. With Side Hustle Banking™, you can manage your dual income streams with ease and efficiency, ensuring your financial journey is as smooth as your entrepreneurial spirit.

|

Have questions for one of our representatives?

Fill out the short form below to hear back within the next business day.

Are you ready to get rewarded?

Open a Complete Checking Account Online

General requirements

- No minimum deposit to open

- No minimum balance requirement

- Debit Mastercard® (to receive the debit card rewards)

Account requirements to receive monthly dividend payout

- Total monthly direct deposits of $150 or more

- Ten or more Debit Mastercard® purchases a month

- eStatements only

|

Why You'll Love Zelle®

|

FAQs about Complete Checking

Zelle® is a fast and convenient way to electronically send and receive money with friends, family and others you trust, even if they bank somewhere different than you. You can use Zelle® to do things like gift people money, pay the sitter, or split the cost of a night out with friends. Zelle® is accessible for members with Members Choice Complete Checking®, Daily Checking and Student Saver Checking, and is available in your online and mobile banking account.

How do I enroll in Zelle®?

Step 1: Log in to the MCCU Houston TX app.

Step 2: In the main menu, select "Transfer and Pay". Then "Zelle®".

Step 3: Enroll your email address or U.S. mobile number.

How can I access Zelle®?

You can send, request, or receive money with Zelle®. To get started, log into the MCCU Houston TX app or online banking. In the main menu, select "Transfer and Pay". Then "Zelle®".

How do I use Zelle®?

To send money using Zelle®, simply select someone from your mobile device's contacts (or add a trusted recipient's email address or U.S. mobile number), add the amount you'd like to send and an optional note, review, then hit "Send." The recipient will receive an email or text message notification via the method they used to enroll with Zelle®. Money is available to your recipient in minutes if they are already enrolled with Zelle®.

To request money using Zelle®, choose "Request," select the individual from whom you'd like to request money, enter the amount you'd like, include an optional note, review and hit "Request". If the person you are requesting money from is not yet enrolled with Zelle®, you must use their email address to request money. If the person has enrolled their U.S. mobile number, then you can send the request using their mobile number.

To receive money, just share your enrolled email address or U.S. mobile number with a friend and ask them to send you money with Zelle®. If you have already enrolled with Zelle®, you do not need to take any further action. The money will be sent directly into your Members Choice Credit Union account, typically within minutes.

If someone sent you money with Zelle® and you have not yet enrolled with Zelle®, follow these steps:

-

Click on the link provided in the payment notification you received via email or text message.

-

Select Members Choice Credit Union.

-

Follow the instructions provided on the page to enroll and receive your payment. Pay attention to the email address or U.S. mobile number where you received the payment notification—you should enroll with Zelle® using that email address or U.S. mobile number to ensure you receive your money.

Possibly. There are a few factors that impact the delivery of your direct deposit. You might get your direct deposit between two days earlier and on your regularly scheduled payday. Here are some reasons why you might not receive your deposit early:

- You recently set up direct deposit for the first time

- Your deposit type is not eligible, such as a bank-to-bank transfer

- There’s a payroll system issue from your payer

- You reached the transaction limit or monthly deposit dollar limit for early processing

- Early direct deposits also depend on timing—your payer must provide payment details on time so the deposit can process early. If your deposit doesn't arrive early, expect it to arrive on your scheduled payday

Set up direct deposit to your checking/savings account for a reliable and convenient way to get paid.

Direct deposit of your payroll, social security or other regular payment can be an effective way to help you budget and protect against identity theft, even while you are away.

EZSwitch Direct Deposit

This is the fast and easy way to setup direct deposit right from your online or mobile banking. Plus, you don't need to reach out to your payor or HR department. Sets up in minutes!

Direct Deposit from your employer

Contact your payor and request to have your payroll check automatically deposited into your Checking/Savings account. Use your member account number to complete the process. Your employer may request this information to set up direct deposit for your regular payroll check:

- Credit Union Name: Members Choice Credit Union – Houston, TX

- Type of account: (checking or savings)

- Routing / ABA number: 313083196

- Account number: Your checking or savings account number - access by logging in to online banking. Here are the steps to find that number:

-

- Go to mccu.com

- Enter your username and password in Account Logins, then click Login

- Once you are in online banking, select the Accounts widget

- Select the checking or savings account you would like to use

- Select Account Details, then locate the full MICR Account Number (13 digits)

Use MyPay if your direct deposit originates from:

- Active Duty Military Service Pay

- Reserve Military Pay

- Military Retirement Pay

- Department of Defenses (DoD) Pay

- Defense Finance and Accounting Services Pay

Use Standard Form 1199A or Go Direct if your direct deposit originates from the United States Treasury for:

For existing members, if you already have a checking account and want to request a checking conversion, use one of these three methods to convert your account to Complete Checking:

- Log into your online banking and click on Quick Apply > Account > Open an additional account > Checking > Select the "Converting an existing checking share" dropdown.

- Fill out our Checking Conversion form and send it to us via online banking by composing a new secured message.

- Fill out our Checking Conversion form and email it to memberservices@mccu.com along with two forms of ID.

- Login to online banking

- Select eDocs from the Accounts menu

- Select the Delivery Preference you would like to change – either all accounts or just select accounts

- Select save

- Review and accept to the site terms

Disclosures

1 Complete Checking Dividend Rates: To receive the stated dividend rate for a particular monthly qualification cycle, you must receive monthly eStatements, at minimum ten (10) debit card purchases per month must have posted and maintain an aggregate minimum direct deposit of $150.00 to this account per month. Rewards will be calculated and paid on the last day of each cycle. If account requirements are not met, the dividend rate on the entire balance is .0% for that monthly cycle.

Complete Checking accounts are Tiered Rate accounts. For these accounts, the specified Dividend Rate for a tier will apply only to the portion of the account balance that is within that tier. The annual percentage yields, which vary depending on the balance in the account, are shown for each tier.

2 Early Pay: Early pay is not dependent upon the account qualifications noted above. At our sole discretion, we may make your money available to you up to two days before we receive the funds from the payor. Early availability of direct deposits is dependent on the timing of your payor’s payment instructions and/or fraud prevention overlays. These limitations may be modified at our sole discretion without advance notice. We do not guarantee early availability of any direct deposits, and eligibility of a direct deposit for early availability may change between pay periods. Any direct deposit not posted early will be made available according to our Funds Availability schedule. We reserve the right to discontinue the service at our sole discretion and without notice.

3 ATM Fee Rebates: For any Complete Checking account, if you have met your qualifications during the monthly qualification cycle (monthly eStatements, at minimum ten (10) debit card purchases per month must have posted and maintain an aggregate minimum direct deposit of $150.00 to this account per month), we will reimburse you for ATM fees imposed during the monthly qualification cycle by our institution and other U.S. financial institutions. The maximum ATM fee rebate is $25 for one qualification cycle. ATM fee rebates will be transferred to your checking account. If you believe that you have not been reimbursed the correct amount, please contact us. We must hear from you no later than 30 days after the statement cycle when the reimbursement was applicable.

- Must maintain an average monthly balance of $2,500 in the business checking account for the previous 90 days to qualify.

- Only members with both the stated business checking account and personal Complete Checking account in good standing qualify.

- Discounts are for an Unsecured Personal Loan or Personal Auto Loan and can not be combined with any other discounts or offers.

- If a member qualifies for both, the discount can apply to both loans.

- The only limit is one unsecured loan discount and one auto loan discount per member.

- Not offered for business lending.